Unlock hidden value in every customer journey

How journey management helps banks uncover root causes of customer churn, reduce operational costs, and increase product uptake—while staying compliant and customer-obsessed

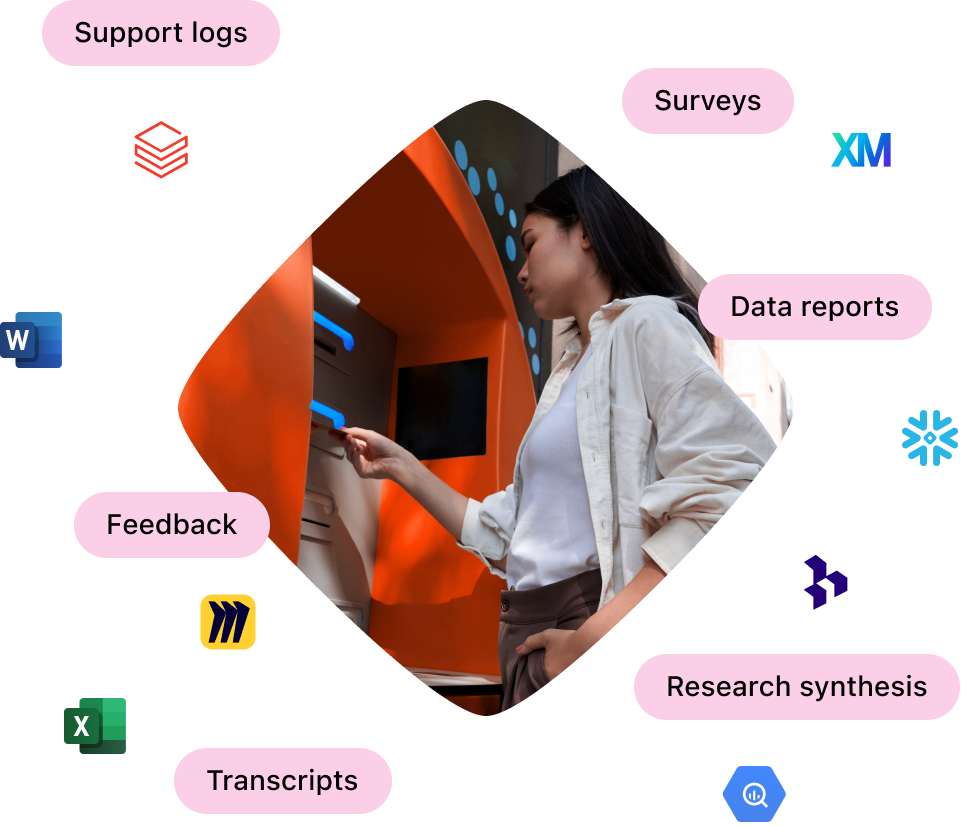

Connect digital and physical channels

Whether online onboarding or in-branch services, journeys reveal where gaps in experience drive lost revenue, dissatisfaction, or inefficiency. Journey-level insight connects digital, call center, and in-person operations.

)

)

Fix onboarding drop-off points fast

Identify verification friction and optimize steps where customers abandon the application process

)

Streamline mortgage approval and servicing

Reveal delays across application, underwriting, and approval to improve speed and reduce abandonment.

Deliver measurable outcomes at scale

Customer journeys reveal where banking products fall short of expectations. With real-time journey data, CX teams and product owners can reduce cost and increase satisfaction by fixing what matters most.

12%

Lower servicing costs

Reduced by fixing checkout and UX issues

18%

Increase loan conversion

by improving application journeys

22%

Repeat purchases

from addressing drop-off in online features

9%

Fewer in-person contacts

as more customers complete tasks themselves

Deliver measurable outcomes at scale

Use TheyDo to align product, CX, and operations around shared journeys—powered by data and designed to deliver value.

Bring together data from Shopify, GA4, Medallia, Zendesk, POS, returns, and fulfillment—all in one place.

See the full story behind every drop-off, complaint, or ticket. Go beyond dashboards.

Use AI to surface the most urgent, expensive, or high-impact experience gaps—then act with confidence.

Link changes to account growth, self-service success, and product adoption.

)

)

Banking-ready templates and collaborative workspaces

Use journey frameworks tailored to financial services—like loan servicing, mobile onboarding, card activation, and branch support—to reduce complexity and highlight quick wins.

Loading testimonial...

FAQs

See your journeys clearly

Because disconnected data doesn’t tell the full story. Ready to see your banking journeys with fresh eyes? Book a call today.